Shipping costs are no longer defined by base rates alone. For many businesses, invoices from carriers are increasingly dominated by additional charges that go far beyond the quoted transportation rate. These add-ons, known as surcharges or accessorial fees, are complex, cumulative, and often obscured in carrier billing structures.

For high-volume shippers, failing to monitor and control these hidden shipping fees can quickly erode profit margins. In this guide, we’ll take a comprehensive look at shipping surcharge analysis, explain how these hidden costs impact overall transportation spend, and outline practical steps for auditing, recovery, and prevention.

What Are Hidden Shipping Surcharges?

Hidden shipping surcharges are additional fees that carriers apply on top of base freight rates. Unlike predictable General Rate Increases (GRIs), these charges often appear mid-contract, sometimes with little to no notice. They can include delivery area surcharges (DAS), fuel adjustments, peak season fees, dimensional weight (DIM) charges, and a wide array of accessorials tied to packaging, routing, or handling requirements.

These costs are not only difficult to forecast but also hard to track. Many are buried within lengthy PDF invoices or hidden in carrier web portals instead of being clearly summarized. According to logistics industry analyses, surcharges can account for 25% to 40% of a company’s total shipping invoice. Without proper monitoring, shippers may have little understanding of just how much they’re paying in hidden fees.

Common Types of Hidden Shipping Fees

Gaining visibility into what you’re actually being charged for is the first step in controlling cost escalation. Here are some of the most common surcharges that impact businesses:

- Delivery Area Surcharge (DAS): Applied to shipments headed to rural, suburban, or high-cost service areas. These fees frequently expand over time, and carriers sometimes adjust zone lists without transparent communication, disproportionately impacting residential deliveries in particular.

- Dimensional Weight (DIM): Carriers don’t just charge by actual weight; they calculate based on the size of the package using proprietary divisors. This means lightweight but bulky shipments can be billed as though they are much heavier, making packaging strategy a top cost driver.

- Fuel Surcharges: Indexed against carrier-chosen fuel benchmarks rather than universally recognized market averages, creating considerable volatility. Since 2020, some carriers have adjusted these calculations multiple times per year, often to their advantage.

- Peak Season Fees: Temporary but significant charges during holidays or other high-volume periods. Carriers often tier these fees based on weekly shipment numbers, creating steep spikes for e-commerce merchants with seasonal demand surges.

- Additional Handling Fees: Triggered by packages that deviate from standard shapes, sizes, or weight categories. Penalties may apply for items over 50 lbs, cylindrical tubes, or packages requiring non-mechanical handling.

- Minimum Charges: Flat floors on shipment pricing that nullify negotiated discounts for lightweight or low-volume shipments, reducing the benefit of rate negotiations overall.

Why Are My Shipping Costs So High?

If your transportation costs have risen despite stable shipping volumes, hidden surcharges are often the culprit. Carriers increasingly rely on these fees as a revenue source to compensate for operational costs and maintain profitability. This “surcharge creep” may quickly outpace your carefully negotiated incentives, leaving CFOs and operations managers with budgetary surprises.

Common drivers include:

- Rising carrier fuel indices

- Expanded DAS postal codes and rural thresholds

- Packaging that fails dimensional weight rules

- Minimal invoice visibility or absence of surcharge-focused audits

Industry surveys show that more than 70% of small-to-mid-size retailers underestimate surcharge costs during annual forecasting, leading to gaps in actual versus projected spend.

The Visibility Challenge

The biggest pain point for many companies is a lack of transparent visibility. Carrier invoices are often dozens of pages long, filled with codes, acronyms, and ambiguous “service adjustments.” Worse, charges may be dispersed across multiple portals or invoice sections, making them difficult to spot. This complexity is intentional: it discourages shippers from questioning discrepancies and obscures the true cost of transportation.

As a result, proactive shipping surcharge analysis is no longer optional — it’s necessary to safeguard profitability.

Surcharge Recovery: How to Audit and Recover Costs

A surcharge recovery audit compares company invoices against carrier service guides, guarantees, and contract terms. The process identifies instances of overbilling or non-compliance. Key audit red flags include:

- Incorrect DAS zone assignments

- Improper dimensional divisor applications

- Minimum charges overriding negotiated rate discounts

- Peak fees applied outside published date ranges

- Miscellaneous accessorial charges billed contrary to carrier rules

Well-executed auditing has been shown to recover 1% to 3% of total annual shipping spend. For high-volume merchants, this adds up to six- or seven-figure savings per year. In many cases, carriers must also credit accounts retroactively, depending on service agreements.

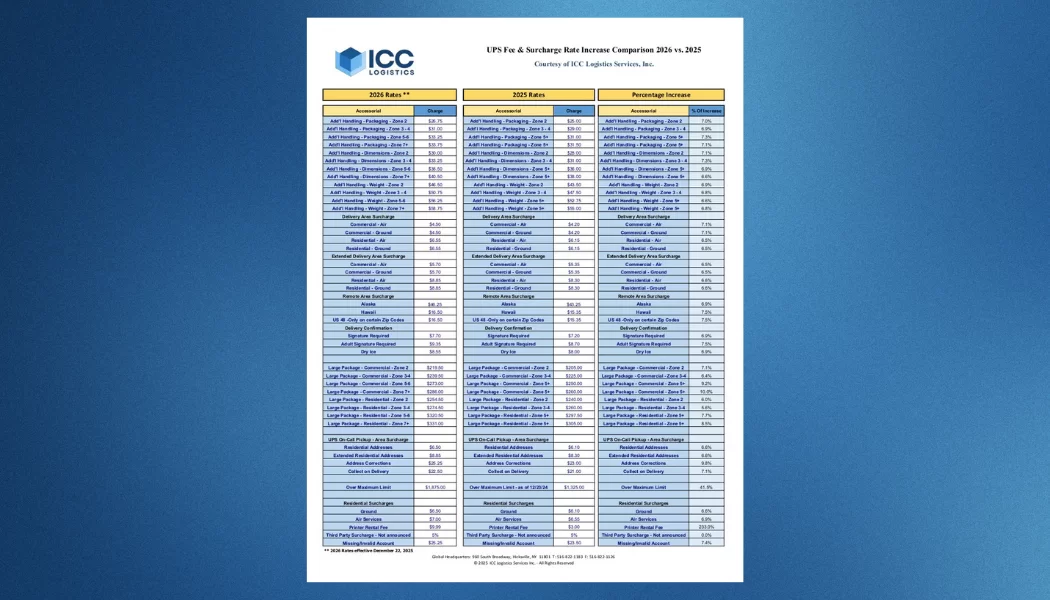

ICC Logistics, with over 50 years of industry experience, offers both Parcel Carrier Audit Services and Freight Bill Audit Services specifically designed to uncover hidden surcharges. Our Parcel Audit Checklist provides logistics managers with a practical tool for proactively spotting common billing red flags.

Controlling Accessorial Costs Going Forward

While cost recovery is important, the ultimate goal is prevention. This requires a focus on education, visibility, and operational refinement. Best practices include:

- Packaging Adjustments: Use right-sized boxes, lightweight materials, and design strategies that avoid exceeding dimensional thresholds or triggering “additional handling.”

- Routing Flexibility: Optimize fulfillment routing to minimize shipments that fall in DAS-heavy regions.

- Contract Negotiation: Leverage consultants to negotiate surcharge concessions based on real-world shipping data, rather than simply accepting base discounts.

- Carrier Diversification: Avoid relying on a single carrier that may unilaterally introduce new fees midyear.

- Regular Audits: Establish auditing as a recurring process, not an emergency fix when budgets are overrun.

FAQ: Hidden Shipping Fees

What are hidden shipping surcharges, and how do they work?

They are additional costs added by carriers beyond base freight rates, often triggered by package size, delivery location, or variable costs such as fuel and seasonality. Because they’re less transparent, they tend to grow unchecked without consistent audits.

How do fuel surcharges and DAS impact shipping costs?

Fuel surcharges are pegged to carrier-defined fuel benchmarks, which change frequently. DAS applies primarily to shipments outside major metropolitan cores, adding extra expense for rural and residential shipments.

Can you recover fees from old shipping invoices?

Yes. Depending on your carrier contract, third-party audits can often recover overcharges retroactively, sometimes across multiple years’ worth of invoices.

What’s the best way to control accessorial costs?

Shippers should invest in visibility tools, work with experienced consultants to renegotiate contracts, diversify carriers, and train their operations staff to recognize packaging and routing choices that keep costs down.

Final Thoughts: Why Shipping Surcharge Analysis Matters

Surcharge creep is a silent but powerful margin killer for manufacturers, distributors, and retailers. Because it doesn’t show up in budgets or sales forecasts, it quietly erodes profitability quarter by quarter. By combining education, proactive contract negotiation, and consistent auditing, companies can transform what was once an uncontrollable cost into a controllable advantage.

At ICC Logistics, our decades of experience in freight and parcel auditing allow businesses to uncover, challenge, and reduce unnecessary shipping costs. For CFOs, COOs, and supply chain executives, ongoing shipping surcharge analysis is no longer a secondary concern; it’s a strategic imperative for long-term margin protection.

Suggested Reading:

- Why a Freight Audit Should Be Your First Cost-Saving Move

- How Contract Negotiation Reduces Carrier Costs Without Sacrificing Service

- Parcel Auditing vs Freight Auditing: What’s the Difference?

- Understanding Surcharge Recovery and Hidden Fees in Shipping

- Stay Ahead of the Latest UPS & FedEx Rate Hikes

to receive our FREE white papers:

to receive our FREE white papers: