Shipping costs aren’t just rising, they’re becoming unpredictable. From sudden accessorial fees and ever-shifting DIM rules to contracts that feel impossible to enforce, transportation budgets are under constant attack. For CFO’s, supply chain leaders, and logistics managers, the pressure is clear: keep goods moving reliably, while proving every freight dollar is accounted for.

That’s why Parcel Audits and Freight Audits have become essential. Both uncover billing errors, recover refunds, and restore visibility into carrier invoices — but they’re not interchangeable. Knowing the difference between the two is critical to deciding where to start and how to maximize cost control.

What Is a Parcel Audit?

A parcel audit examines small-package shipments handled by carriers such as UPS, FedEx, DHL, USPS, and regional couriers. These audits are most commonly used by e-commerce retailers, direct-to-consumer (DTC) brands, subscription-box services, and any company consistently shipping thousands of packages each month.

Core functions of parcel audits include:

- Identifying dimensional weight (DIM) mischarges, where billed weight exceeds actual weight.

- Spotting missed guaranteed service refunds (GSRs) for late deliveries.

- Detecting phantom accessorials such as residential surcharges, weekend delivery fees, and delivery area charges.

- Correcting duplicate charges or invoices billed after cancellation.

Because parcel shipments involve high volume but relatively low revenue per package, these audits are highly automated. Modern parcel audit systems track invoices, flag inconsistencies, and auto-dispute errors within carriers’ claim windows. Consistently performed, parcel audits generate steady monthly savings while helping businesses adapt to frequent changes in carrier rules, accessorial fees, and DIM calculations.

What Is a Freight Audit?

A freight audit applies to larger shipping modes—including Less-than-Truckload (LTL), Truckload (TL), ocean freight, air freight, and intermodal transportation. Unlike parcel shipments, freight bills involve fewer invoices but significantly higher costs per transaction, making errors especially costly.

Core functions of freight audits include:

- Identifying NMFC misclassifications that inflate LTL costs.

- Correcting incorrect rate applications and reweigh disputes against negotiated tariffs.

- Flagging manual invoice input errors from carriers.

- Reviewing additional charges like re-delivery, liftgate, and detention fees.

- Uncovering discrepancies in international shipments, including demurrage, customs handling, and fuel surcharge markups.

Freight audits deliver high-impact cost recovery because overages on freight invoices can be thousands of dollars per shipment. They also hold carriers accountable by validating that billed rates align with contract terms. For organizations moving goods across multiple shipping modes, freight audits provide critical financial visibility and control.

Parcel Audit vs Freight Audit: Key Differences

While both audits identify errors and reduce overspend, the differences lie in the cost structures they target:

- Parcel Audits → Best for high-volume, low-cost shipments (eCommerce, retail, subscription models). The savings come from automation and frequent billing verification.

- Freight Audits → Critical for larger shipments (LTL, TL, international). Impact per invoice is far greater, and audits ensure contracts are enforced.

If your logistics budget is driven mainly by parcel shipping, begin with a parcel audit. If your shipping spend is concentrated in freight—especially international—start with a freight audit. The decision depends on where your greatest risks and highest costs reside.

When Should You Start With a Parcel Audit?

Beginning with parcel audits makes sense if:

- You ship thousands of small packages per month.

- You face frequent DIM charges, residential delivery fees, or weekend surcharges.

- You want automated, recurring savings that minimize manual oversight.

Many businesses fail to collect refunds simply because GSR claims must be filed within short windows—sometimes just 15 days. Without automation, this refund opportunity expires quickly. Parcel audits prevent those leaks while pinpointing inefficiencies at the transactional level.

When Should You Start With a Freight Audit?

Freight audits should be the first choice if:

- Your company’s largest spend lies in LTL, TL, or international freight transactions.

- You want protection against manual invoicing errors and costly misclassifications.

- You need data-driven enforcement of carrier contract terms.

These audits prove especially valuable for companies facing persistent disputes over NMFC classification, density-based mischarges, or hidden international add-ons like customs management fees. The financial exposure on freight bills is far larger than parcel, making incorrect invoicing far more impactful.

Why Many Shippers Run Both

While businesses often begin with one type of audit, true visibility comes from running both in parallel. By combining parcel and freight audits, companies can:

- Gain a complete picture of carrier performance across shipping modes.

- Identify long-term trends by comparing mischarges across contracts.

- Strengthen negotiations with carriers by leveraging recurring audit findings.

At ICC Logistics, we frequently find patterns across different shipping types. For example, a manufacturer may uncover persistent LTL misclassification issues while simultaneously battling DIM inflation in parcel. Running both audits provides the leverage needed to negotiate carrier-friendly contracts holistically instead of in isolation.

Risk Factors to Watch

Parcel Audit Risks

- Frequent, unannounced DIM rule changes.

- Missed refunds due to narrow GSR claim windows.

- Accessorial fees can represent up to 40% of shipping costs for some companies.

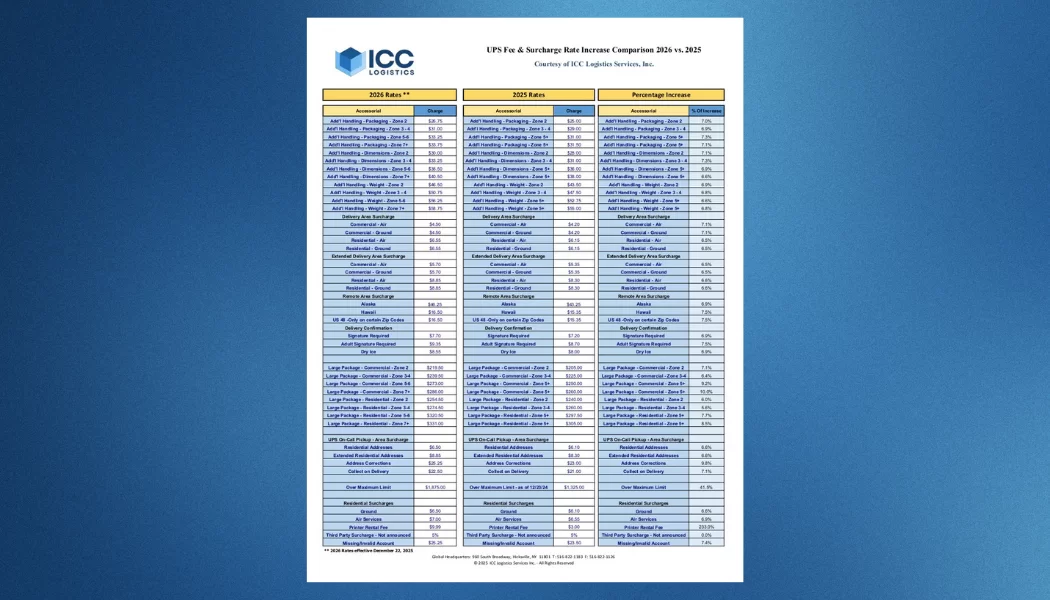

- Mid-year carrier increases often slip by unnoticed without routine audits.

Freight Audit Risks

- LTL invoices are often entered manually, creating a higher scope for human error.

- NMFC reclassification and density miscalculations routinely inflate costs.

- Carriers may add unjustified accessorials such as liftgate or limited-access charges.

- International freight invoices often hide adjustments in fuel and demurrage charges.

Both types of shipping carry risks—but the scale and type of financial exposure vary significantly. Parcel involves frequent small errors; freight involves fewer but costlier mistakes.

How Freight Audit and Payment Services Fit In

Beyond audits alone, many shippers turn to freight audit and payment (FAP) services, which combine invoice validation and payment execution. By integrating audit and settlement in real time, organizations avoid the inefficiency of paying incorrect invoices first and disputing later.

FAP brings measurable benefits, including:

- Improved working capital and more predictable cash flow.

- Reduction of back-office workload related to invoice disputes.

- Consistent tracking and reporting for CFOs and finance teams.

Which Audit Should You Use First?

- Start with parcel audits if your shipment volumes are high and you need quick, automated recovery.

- Start with freight audits if individual invoice values are high, and your spend is concentrated in TL, LTL, or international freight.

- Use both simultaneously for complete visibility, stronger carrier negotiations, and maximized cost control.

How ICC Logistics Supports You

With more than 50 years of expertise, ICC Logistics has helped businesses recover millions of dollars in overcharges across both parcel and freight spend. We provide end-to-end solutions that include parcel audits, freight audits, contract compliance, and carrier negotiations—ensuring clients reduce overspend, increase transparency, and build stronger supply chain resilience.

For executives, our services deliver measurable ROI and improved financial predictability. For operations teams, we provide benchmark-driven insights to strengthen negotiating power and safeguard profit margins in volatile shipping markets.

FAQs

What’s the difference between a freight audit and a parcel audit?

Parcel audits focus on high-volume, small-package shipments, while freight audits address high-value invoices in LTL, TL, ocean, and air freight.

When should you choose a parcel audit vs. a freight audit?

Choose a parcel audit if most of your transportation is small parcels. Choose a freight audit if the majority of spending is tied to large, complex freight modes.

Can you run both freight and parcel audits together?

Yes. Running both audits offers complete oversight and maximizes leverage during carrier negotiations.

How do different audit types uncover different cost risks?

Parcel audits catch missed refunds and small billing discrepancies. Freight audits address classification errors, contract compliance gaps, and large-scale rate misapplications.

Suggested Reading:

- Why a Freight Audit Should Be Your First Cost-Saving Move

- The Invoice Trap: Why Freight Invoice Errors Happen

- Understanding Surcharge Recovery and Hidden Fees in Shipping

- What’s The Process For Negotiating Better Freight Terms?

- Stay Ahead of the Latest UPS & FedEx Rate Hikes

Subscribe to Logistics Strategies

No noise. Just insights.

Get direct access to every post, resource, and real-world breakdown. From parcel trends to freight cost strategies — all backed by 50 years of logistics expertise.

Every post lands in your inbox, ad-free and to the point. Prefer to listen? Use the Substack app for a clean, distraction-free experience with audio and community features.

Join a community that gets it.

We’re building a space for supply chain pros, ops leaders, and curious minds who want to stay sharp – without the fluff. Your voice is welcome here.

To learn more about the tech platform that powers this publication, visit Substack.com.

to receive our FREE white papers:

to receive our FREE white papers: