Most companies will tell you they have comprehensive audit controls in place for many, if not all of the functions they perform. Well, if you consider all of the data breaches we hear about week after week, you have to take those comments with a grain of salt. While transportation and logistics expenses may not contain sensitive information that can put a company in jeopardy of being sued or having to pay extremely large fines, lack of audit controls will make company’s vulnerable to paying much more than they should for their transportation and logistics costs year after year. In some cases, these increased costs go on year over year without anyone in the “C” suite having any idea that their bleeding dollars.

A fact that at least one major corporation experienced as you will see when you finish reading this post.

Very often “audit” processes are entirely left up to the accounts payable department as part of the invoice payment function. Any company that relies solely on their accounts payable department as the only source for audit controls is missing the boat and setting itself up for paying much more than they should for transportation and logistics services. Not only that, they may also be subject to fines and penalties for utilizing non-licensed service providers, or not adhering to strict import and export regulations. Here are some key areas that require considerable expertise when it comes to providing comprehensive transportation and logistics audit controls.

- IMPORTS: Invoices for imported goods are extremely complex and contain a variety of items that must be comprehensively audited to ensure that a company does not pay more than it should for the services provided, or pay fines for violating Federal rules and regulations. First of all import rates are extremely volatile and can change on a dime based on a variety of factors, including the day the goods are shipped. It may be cheaper to ship goods over the weekend instead of during the week, or to take advantage of consolidated shipment services and not ship goods on an individual order basis.

The type of service provided for ocean shipments will also vary from port to port, so knowing when the goods actually need to be at their final destination is critical to obtaining the most competitive rates available. What are the correct freight terms for the various shipments? Who is responsible for paying inland freight charges in the origin country? Who is responsible for the inland freight costs once the shipments arrive here in the US? Has the company benchmarked the various rates that are available and does the accounts payable department truly understand the ocean freight costs and ancillary charges which vary widely between forwarders and change oftentimes during the year based on import supply and demand?

What about Duty rates, does the accounts payable department really know the correct duty rate for the various products a company imports…probably not.

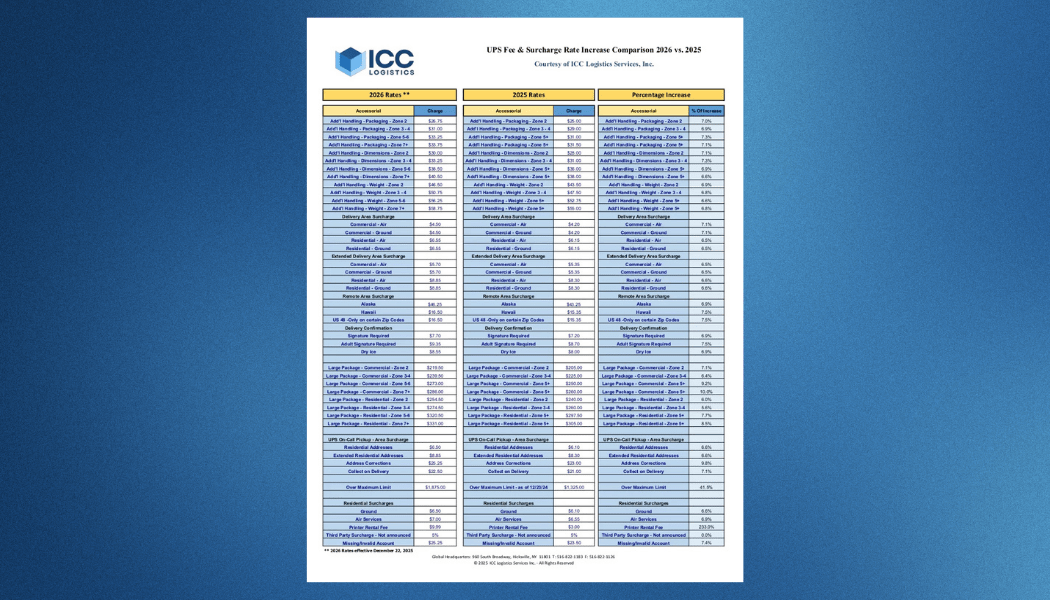

- Parcel Shipments: We hear over and over again from clients and prospects that their accounts payable department performs an audit on the company’s parcel carrier invoices. To be totally frank here, that is virtually impossible. Parcel carrier invoices vary from carrier to carrier and in some cases the paper invoices themselves do not contain all of the shipment information that is required to perform a comprehensive audit.

Also, the sheer volume of parcel invoices many companies receive makes it impossible to track every package to make sure it was delivered on time and to file for refunds for those late delivered packages. And, most importantly make sure the company actually receives a refund for the late shipments.

Discounts also vary based typically on annual rolling averages, and that information is also difficult to determine if you are not an “expert” in auditing parcel carrier invoices.

- LTL Shipments: Over the years we have found many companies processing these LTL invoices for payment without first matching the invoices to the bill of lading. Without the bill of lading matching process how would the payables department know their company is responsible for the freight charges. The bill of lading is the contract of carriage and states whether the shipment is prepaid, (paid by the shipper); Collect, (paid by the consignee); or perhaps a Third Party billing which means the shipment is to be paid by a party other than the shipper or the consignee.

How would the accounts payable department validate the true weight of the shipment; is the shipment actually 5000 pounds or only 500 pounds? How can the rates the carrier charged be validated without knowing the actual freight classification, carrier base rates, discount applications, fuel surcharge percentage, (which is based on the average price of diesel fuel on the date of shipment). What about accessorial fees, did the shipment actually require a lift gate for delivery? Was a lumper required for delivery?

Don’t get us wrong here, we absolutely have no problem with a company utilizing their accounts payable department to perform a cursory audit and process transportation invoices for payment. Where we have a problem is relying on the accounts payable department to be fully responsible for providing a comprehensive audit.

But wait, there’s good news and a concrete solution for these companies to receive comprehensive audit controls by having all of their transportation and logistics invoices post audited by firms that specialize in these services and actually perform the service after the invoices have been paid. These firms work on a gain share percentage of the actual recoveries they receive for their clients. No recoveries, no fees charged! How can a company pass up this deal? Sorry to say…..many, many companies do.

Some companies on the other hand have outsourced the audit and payment function for their transportation and logistics invoices to a third party freight audit and payment firm. Benefits include comprehensive audit processes, much lower invoice processing costs, comprehensive and detailed reports on their shipping lanes, cost per unit, data metrics and analysis to help these companies better manage their overall costs now and into the future.

Even companies that do outsource their transportation and logistics invoice processing should also consider a post audit firm as a “sanity check” on the primary auditor.

There is one story that sticks in our head that clearly validates the value of post auditing services involves a large company that contracted post audit services for all of its global divisions. A major part of the audit results for the company involved recoveries of $9 Million dollars in duplicate payments covering many invoices that were paid by various divisions without the individual divisions knowing the other division also paid the same invoices.

Well, if that doesn’t convince a company that post audit services are critical for any and all business, regardless of how they process their invoices for payment, especially multi divisional companies, perhaps nothing will.

to receive our FREE white papers:

to receive our FREE white papers: