Freight contracts shouldn’t sit untouched for years. Your shipping profile changes, carrier behavior changes, and rates almost always creep up in the background. What started as a competitive agreement can turn into unnecessary spend fast.

Renegotiation isn’t about being aggressive — it’s about being aligned. The strongest negotiations happen when you bring real data to the table, not guesses or gut feelings. That’s where freight audits become more than a recovery tool. They become leverage.

Why “Gut Feel” Negotiations Fall Apart

Walking into a rate discussion without data is basically walking in blind. Carriers show up with their own numbers, performance reports, and justifications. If all you have is a sense that “rates feel high,” the conversation shifts in their favor.

Audit data flips that dynamic.

A good audit gives you clear proof of:

- where you’re being overcharged

- which fees are creeping up

- how often errors happen

- where the contract isn’t being followed

- what your real volume and service mix look like

When you negotiate with facts, the conversation changes immediately.

Signs It’s Time To Renegotiate Your Contract

You don’t wait for a crisis. You look for signals. Here are the ones ICC sees most often:

1. Rate creep

New fees, quietly updated rules, “temporary” surcharges — all of it adds up.

2. Big volume changes

If your volume has grown or dropped, your contract should reflect it.

3. Service failures

Late deliveries, claims, missed KPIs — if the carrier isn’t meeting expectations, terms should change.

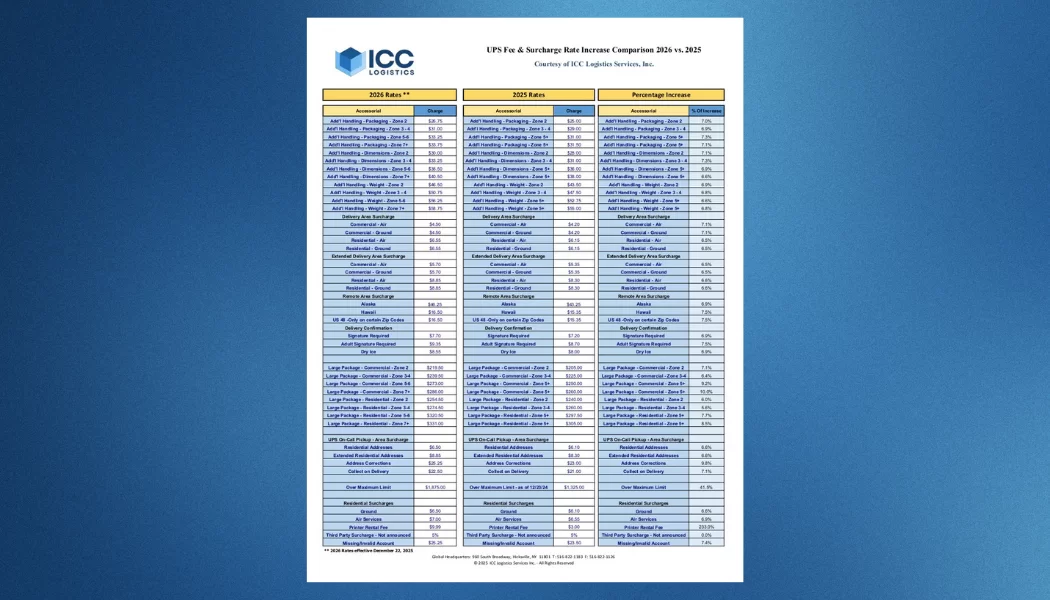

4. Accessorial overload

If accessorials make up 20–30% of your bill, something is off and needs to be renegotiated.

5. Network shifts

New facilities, lane changes, modal changes — all require a fresh cost structure.

Your contracts should match the operation you have now, not the one you had two years ago.

How Freight Audit Data Strengthens Your Negotiation

Audits do more than fix incorrect invoices. They give you the numbers that carriers can’t argue with.

Here’s what audit data provides:

Cost trends

Where spend is rising, which fees have drifted, and how much that creep has cost you.

Performance clarity

Actual on-time %… not the one in the carrier’s slide deck.

True shipment profile

Your real weights, lanes, service levels, and accessorial patterns — not estimates.

Market benchmarks

How your rates stack up against similar shippers.

Recurring billing issues

Wrong zones, dimensional errors, misapplied fuel, and incorrect classifications — all of which become leverage for new terms.

Audit data = your negotiation currency.

Real Savings From Data-Driven Renegotiations

A few examples:

Electronics manufacturer:

Audit data exposed wrong fuel surcharges and misapplied residential fees. With hard proof, they renegotiated and cut annual spend by 12%.

Enterprise LTL shipper:

Audit showed their regional freight was being billed under outdated, premium rate structures. They renegotiated using the findings and saved six figures in the first year.

Clear data gets clear results.

How To Use Audit Insights Effectively With Carriers

ICC recommends a simple structure:

1. Validate your data internally

Make sure shipment records, invoices, and audit findings line up.

2. Prioritize the big wins

Focus on accessorial categories, threshold changes, or routing issues that deliver real savings.

3. Frame the discussion as collaborative

Data isn’t an accusation — it’s a starting point to fix inefficiencies on both sides.

4. Quantify the opportunity

Show how much you’ve been overpaying, and what you save if the issue is resolved.

5. Build the results into your next audit cycle

New terms should be monitored from day one.

This structure keeps conversations fact-based and constructive.

Audit Data = Leverage

Carriers respect clean, verified numbers. When you bring real data to a negotiation, you shift the conversation from:

“Can you revisit my rates?”

to

“Here’s the documented cost impact — let’s fix it.”

That’s the difference.

Audit-backed renegotiation isn’t about pushing harder. It’s about negotiating from a place of clarity.

ICC helps teams turn their audit results into better contracts, stronger accountability, and measurable long-term savings.

FAQ

When should we renegotiate?

Every 12–18 months, or sooner if volumes shift, service drops, or fees spike.

What are the biggest renegotiation triggers?

New surcharges, repeated accessorials, service failures, network changes, or pricing that no longer matches your volume.

How does audit data help?

It gives you the objective facts that support better terms and correct systemic billing issues.

Does audit data create leverage?

Yes. It highlights patterns carriers can’t ignore.

When do shipping trends justify a new contract?

Anytime your network, routing, or volume changes in a meaningful way.

to receive our FREE white papers:

to receive our FREE white papers: