Surprise Surprise!

Most people like a nice surprise, especially when it’s a good one! Yesterday, the parcel shipping world received a nice surprise. FedEx provided an earlier than normal announcement of their General Rate Increase (GRI) for next year. Surprisingly some of the increases that they announced were less than those imposed last year. FedEx announced that their rates for Express and Ground Services will increase by 5.9% (on average) in 2024. While it is nice to hear that the increase for FedEx is lower than expected, this is certainly no reason for celebration!

Last year the GRI for both FedEx and UPS came in at 6.9%. Many experts, including ICC Logistics, have been predicting record level increases for Parcel Carriers in 2024, driven by the expensive new UPS-Teamster contract. It has been reported that this new agreement will cost UPS $30B over the next five years.

Early speculators are saying that this move by FedEx is designed to put pressure on UPS and their profit margins. It is hard to say how UPS will react to this. One would expect that they did have plans to push through a rate increase designed to soften the blow of the higher costs associated with the new Teamster agreement. We had expected a GRI of at least 6.9% by UPS. But, due to this new pressure in the market, they may be forced to mirror the 5.9% increases announced by FedEx, and find some other way to improve profit margins.

If UPS decides to go this route and match the FedEx 2024 GRI amount, they will need to find creative ways to improve margins. Let’s face it, UPS and FedEx are no strangers to creative pricing. First of all, it’s important to point out again that the announced GRI’s are just average increases. The actual impact of the rate increases will vary greatly for shippers. Many factors will drive the bottom line increases that a shipper will experience including average weight and zone of packages, package dimensions, increases in accessorial rates, as well as potential changes to accessorial rules and/ or the introduction of new accessorial fees. Also, the verbiage and elements of carrier agreements can affect the bottom line impact for shippers.

Carriers have been using accessorials as a creative way to improve profitability for a long time. Many years ago, the Delivery Area Surcharge (DAS) was introduced by UPS and FedEx for certain zip codes. Then new categories of delivery surcharges were added, accompanied with higher charges. First the Extended Delivery Area surcharge (EDAS) came into play. In more recent years (2022 to be exact) – the Remote Area surcharge was created. This sneaky little surcharge carries a price tag of $13.05 per package in 2023 for UPS, and is typically not covered by discounting that shippers may have in place for DAS or EDAS. UPS published charges for DAS and EDAS are $5.30 and $7.15 in 2023.

On top of this, both carriers usually make adjustments to the zip codes that these Delivery surcharges apply to. Our analysis has shown that UPS has continued to move DAS Zip Codes to the EDAS category and EDAS into the Remote Area Surcharge category. In 2023 UPS had approximately 400 more Remote Area Surcharge zips listed than they did in 2022. We are speculating that this practice will continue in 2024 and beyond.

Both Carriers have made changes to rules that govern Dimensional Weight as well as Additional Handling Charges over time. In 2015 both carries lowered their Dimensional Weight Factors from 166 to 139, which increased costs for most shippers. Both have also introduced new rules that apply to Additional Handling surcharges. For example, in 2016 both carriers lowered the length of packages (longest side) from 60 inches to 48 inches before the surcharge applied. New categories of Additional Handling have been added over time, and now include extra charges for specific weight, combined length and girth, length, width, as well as packaging. Published charges for Additional Handling vary from $16.50 to $34.50 for UPS and $16.50 to $36.00 for FedEx (per package).

There are also many interesting rules that govern situations where carriers reserve the right to charge Additional Handling Fees. UPS has one listed in their Service Guide under rules for the application of Additional Handling for Packaging. It states that they can charge an Additional Handling Charge for Packaging for “Any article that is encased in a soft-sided pack (e.g., poly bags and bubble mailers) that exceeds 18 inches along its longest side or 14 inches along its second-longest side or 6 inches in height.” We know that many shippers use these larger size poly bags to ship their product (especially those that ship clothing/ garments). However, up until this point, we have not seen any wide scale enforcement of this rule. Not sure why, but this could be a creative way to help bolster profits.

So, our point with all of this is that it really doesn’t matter if UPS matches the FedEx GRI or not. The bottom line is that 5.9% is still a hefty increase! On top of this, it is only an average, and the impact could be much greater for shippers, especially when the carriers start playing the “Smoke and Mirrors” games that they play. It is obvious that carriers have many levers that they can pull to help improve their profits. Many of these are not so obvious to the average shipper.

The big questions are “What is the specific impact to you, the Shipper?” and “Do you have contracts that can help shield you from potential rate increases that can damage your bottom line?” We would expect that you don’t want to be unpleasantly surprised by unplanned/ unexpected increases in costs in 2024. ICC Logistics has a long history of delighting customers by driving significant cost savings that they didn’t know existed. Please reach out to us today to ensure that the surprise that you experience with your 2024 carrier rate increase impact is a good one!

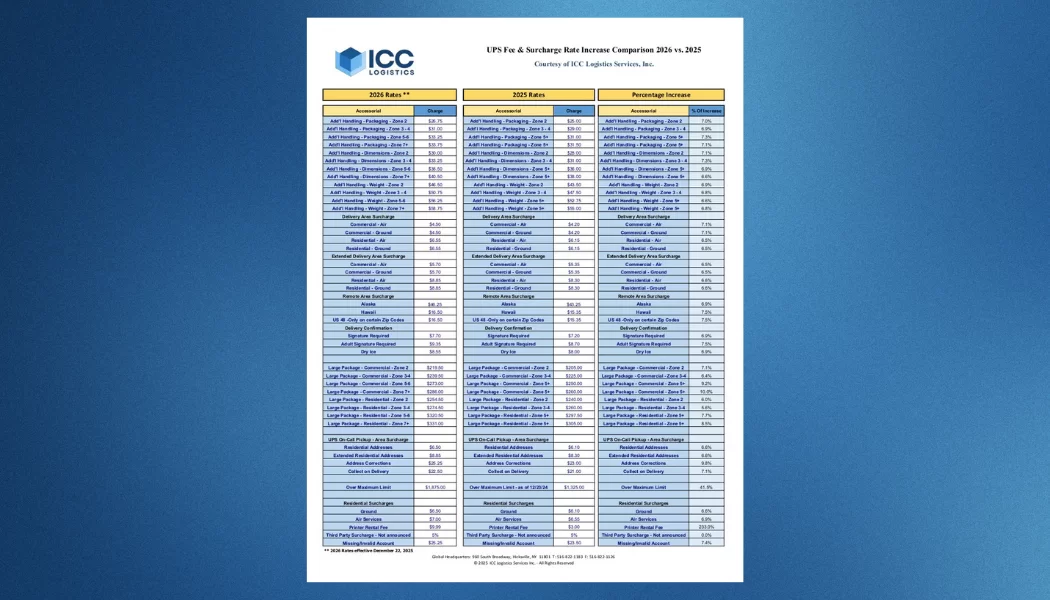

And, as an added bonus, ICC, (which we have done for decades now), will be publishing FedEx and UPS Rate Comparison Charts comparing 2023 rates, with the new 2024 rates just as soon as the revised rates are officially published by FedEx and UPS. Be on the lookout for this incredibly valuable information.

to receive our FREE white papers:

to receive our FREE white papers: