Shipping contracts are infamous for their complexity. Packed with fine print, these documents stretch across dozens of pages with rates, discounts, and conditions that might appear harmless. Yet, hidden within the legal jargon are clauses that can quietly drain your profits — sometimes costing companies hundreds of thousands or even millions. For organizations managing large freight or parcel spend, the most dangerous lines aren’t highlighted in bold but are instead concealed in the addendums and rate guides. This is why shipping contract analysis has shifted from being a best practice to a business necessity.

Why Shipping Contract Analysis is Critical Today

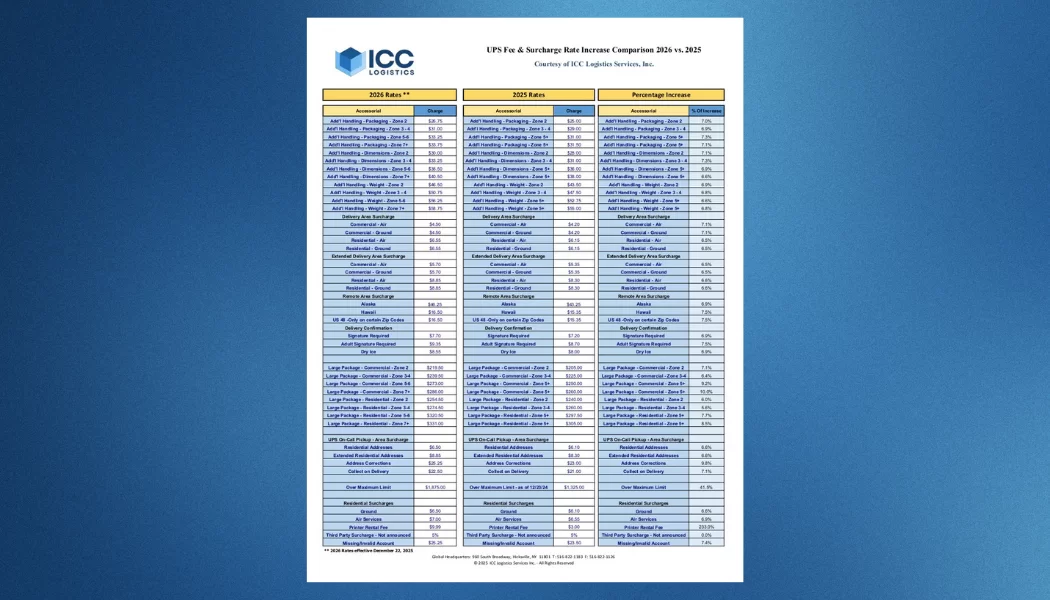

The modern shipping landscape has grown increasingly expensive. Fuel price volatility, rising labor costs, and consistent increases in carrier surcharges have driven freight and parcel expenses upward. Yet one of the least recognized but most influential cost drivers isn’t external; it’s the carrier contract itself.

Today’s agreements often contain clauses that quietly benefit carriers at the expense of shippers, such as:

- Minimum charge penalties that negate negotiated discounts by enforcing bottom-line pricing.

- Dimensional billing rules that reclassify shipments mid-term and inflate costs unexpectedly.

- Escalating accessorial fees that spike with volume or threshold changes.

- Early termination clauses that punish companies for shifting freight volumes to alternative carriers.

On paper, these clauses may look minor at signing, but when freight volumes and conditions change, they can quickly spiral into six- or seven-figure costs. In a market where margins are thin, ignoring such clauses can prove financially devastating.

Hidden Costs in Carrier-Friendly Clauses

One of the biggest dangers in carrier contracts is that many cost-driving provisions remain inactive until triggered. This means that they can go unnoticed for months or even years, until your shipping program hits a threshold where they activate suddenly.

Some common but costly examples include:

- Zone shifts: A small adjustment to your distribution network can reposition zones, changing how packages are rated and inflating costs overnight.

- Volume triggers: Discounts tied to shipment minimums disappear if volumes fall short, erasing savings when business slows.

- Surcharge escalations: Carriers frequently alter surcharge formulas mid-year, allowing hidden increases to slip through with little notice.

Because these charges are buried deep in service guides and addenda, they remain invisible until they quietly erode your profit margins. By then, it’s often too late to prevent costly overspending.

Why Many Shippers Miss These Clauses

Shipping agreements are often bundled with supplemental materials like rate guides and service addenda, documents filled with highly technical language. Reviewing every detail is time-consuming, resource-intensive, and frequently beyond the capacity of internal logistics or finance teams. Even experienced negotiators can overlook subtle conditions that activate years into an agreement.

This is where external expertise makes the difference. At ICC Logistics, we specialize in identifying hidden traps and interpreting how contractual fine print impacts your business across multiple dimensions: parcel, freight, and global shipping. Our analysis helps shippers uncover vulnerabilities early, protecting budgets before costs escalate.

Contract Analysis: A Financial Health Check

Treating contract analysis solely as a legal review misses the point. A comprehensive review is more like a financial health check-up for your shipping program. Effective analysis can reveal:

- Where your contract is underperforming compared to market norms.

- Charges that are avoidable, negotiable, or incorrectly applied.

- Clauses exposing your company to unplanned increases down the line.

- Opportunities for cost savings through smarter renegotiation strategies.

Our process translates complex contract terms into plain, actionable insights for CFOs, COOs, procurement leaders, and supply chain executives. Instead of sifting through industry jargon, decision-makers receive strategic recommendations that deliver measurable financial outcomes.

When Should Shippers Review Contracts?

Carrier contracts should never be treated as “set it and forget it” agreements. Instead, they require proactive review at key moments, such as:

- Annually – to benchmark against evolving market conditions.

- During network changes like opening new distribution centers, mergers, or geographic expansions.

- When shipping volumes fluctuate significantly, either increasing or decreasing.

- If unexpected surcharges or cost overruns begin appearing on invoices.

With more than 50 years of experience, ICC Logistics has found that shippers who revisit contracts regularly avoid costly renegotiation mistakes and maintain strong leverage with carriers before expenses spiral out of control.

Risks of Not Reviewing Carrier Contracts

Failing to conduct a thorough contract analysis exposes shipping departments to unnecessary and often avoidable risks. The most common include:

- Unplanned Cost Increases – caused by dimensional billing, rising accessorials, or mid-year surcharge changes.

- Lost Negotiation Power – delaying renegotiation forces shippers to renew contracts under pressure with weaker terms.

- Compliance Gaps – without audits, companies may never realize when carriers incorrectly apply rates or surcharges.

- Financial Exposure – unfavorable clauses lock companies into high spend during downturns or when freight volumes dip.

Without visibility and ongoing review, shippers effectively gamble with one of their largest controllable expenses.

ICC Logistics’ Approach to Shipping Contract Analysis

At ICC Logistics, contract analysis is not a cookie-cutter process—it’s a custom diagnostic designed for each client’s shipping profile. Our experts dive deeply into:

- Fine print in parcel and freight contracts.

- Carrier-specific pricing structures and addenda.

- Historical shipping performance and cost data trends.

- Undercapitalized areas for discount optimization.

From there, we produce tailored recommendations that empower shippers to negotiate from a position of strength, avoid mid-contract surprises, and drive long-term cost efficiency.

Real-World Example: Silent Margin Creep

Consider an ICC client who unknowingly accepted a clause tying fuel surcharge escalations to oil market benchmarks in their UPS agreement. Believing it would never apply, they didn’t anticipate the impact. However, when fuel prices surged, the surcharge clause triggered, piling on hundreds of thousands in unexpected charges, completely negating the client’s prior negotiated savings.

With ICC’s intervention, the contract was restructured to remove the escalation trigger, eliminating future exposure to this hidden cost driver. This case highlights exactly why expert contract analysis is a critical safeguard against margin erosion.

FAQs

What hidden clauses should you look for in a shipping contract?

Watch for minimum charges, dimensional weight rules, escalator clauses tied to surcharges, early termination penalties, and performance-based incentives that look attractive at signing but create risks later.

Why is shipping contract analysis important?

It protects your business from unplanned expenses, ensures compliance with agreed-upon terms, and strengthens your negotiating leverage during future renewals.

How can contract terms affect your freight and parcel costs?

Even a single overlooked clause around dimensional weight or accessorial fees can turn projected savings into unexpected losses once shipping activities shift.

What are the risks of not reviewing carrier contracts?

The risks are significant: higher shipping costs, missed refund opportunities, exposure to penalties, and disadvantageous renewal negotiations.

The Bottom Line

Today’s shipping environment is too volatile for shippers to skim contracts and hope for the best. In fact, analyzing shipping contracts is just as important as auditing invoices or evaluating carrier performance. Without it, organizations risk margin erosion, unexpected surcharges, and weakened bargaining power.

For over five decades, ICC Logistics has partnered with companies to navigate the nuances of freight and parcel agreements. Our work helps executives secure cost stability, prevent “silent margin creep,” and build stronger, smarter relationships with carriers. A contract may appear fair today, but it’s the hidden lines you don’t see that often carry the greatest financial risk.

Suggested Reading:

- How to Stop Carriers from Taking Back Your Parcel Discounts

- Parcel Auditing vs Freight Auditing: What’s the Difference?

- Understanding Surcharge Recovery and Hidden Fees in Shipping

- How to Cut Parcel Shipping Costs with a Parcel Audit

- Why a Freight Audit Should Be Your First Cost-Saving Move

to receive our FREE white papers:

to receive our FREE white papers: