First, it’s important to understand what is meant by the term duopoly. “A duopoly is a situation where two suppliers dominate the market for a commodity or a service.” Many folks would site Visa and MasterCard as companies that can be clearly defined as a duopoly. Can the same be said for FedEx and UPS?

With the United States Postal Service playing such a significant role in last mile package delivery and regional parcel carriers popping up all over the place to grab a share of this multi-billion dollar opportunity, one might not think so. However, many do believe that FedEx and UPS clearly represent a duopoly, at least as far as shipper’s perceptions are concerned.

For years these carriers have been competing head to head for the tremendous parcel shipping volumes that continue to grow at a staggering pace. Service provided by these companies is incredibly reliable considering the volumes each company handles. Both companies are keenly aware of each other in terms of accounts each controls, accounts each has set as target accounts and accounts they are more than happy to see the “other guy” handle. They often refer to each other as “their competition” usually not even mentioning the competitor by name.

Now it appears that their duopoly may be about to get rocked by the one company that just might be able to break this long-standing duopoly. That company is none other than Amazon Shipping.

We’ve known for years that Amazon has been steadily building and strengthening their delivery network with the addition of leased aircraft, fleets of trucks and incorporating parcel delivery partners to enhance their delivery service. Initially it was thought that these moves were needed to ensure Amazon continually has the delivery capacity it needs for its ever-growing Prime business customers. Many however felt from the beginning that these moves were directed by Amazon management to ensure they would have less reliance on FedEx and UPS as primary parcel service providers and ultimately have the ability to compete head to head with both carriers.

Now, over the past week or so, we’re hearing an awful lot of talk about how Amazon is ready to “poach” UPS and Fedex’ customers by offering parcel shippers lower rates than they have traditionally been paying to FedEx and UPS. Apparently this move is a “full steam ahead” approach by Amazon to compete directly and head to head with UPS and FedEx for their customers.

According to a recent Wall Street Journal Article, Amazon Shipping has sent letters to New York based shippers who sell goods on Amazon. The letter stated that Amazon is “always working to develop new, innovative ways to support the small and medium businesses who sell on Amazon, including testing shipping programs that help these businesses get packages to their customers quickly and reliably.”

While the focus of Amazon’s letter was fairly generic, both UPS and FedEx’ stock fell, 1.7% and 1.3% respectively, immediately following this report. So, obviously investors and those in the know think this move by Amazon may just have a direct impact on FedEx and UPS’ business in the future.

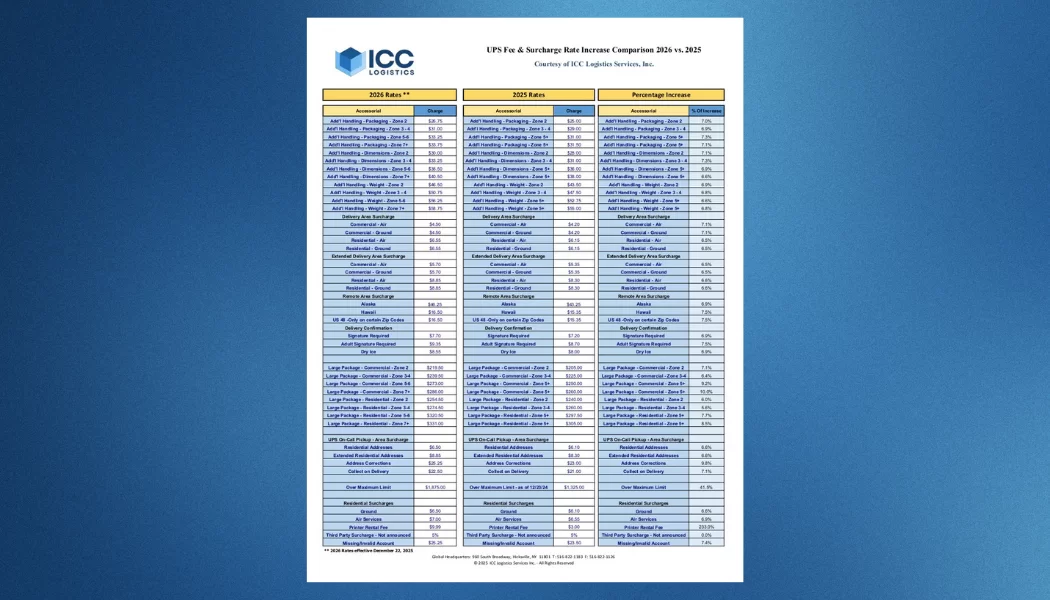

One of the key areas Amazon is focusing on to woo these customers from FedEx and UPS is with an offer to reduce some of those pesky surcharges that UPS and FedEx charge their customers. These surcharges when added up on an individual shipment, can represent as much as 30% of the overall shipping charges assessed by FedEx and UPS. They include Surcharges, such as Residential Delivery Charges, Fuel Surcharges, Peak Season Surcharges, etc.

Apparently Amazon’s goal is to lure shippers away from FedEx and UPS that currently sell goods through the Amazon network. At least that’s what appears obvious as their initial volley into the customer poaching business. The next question then would be, is Amazon willing to offer these parcel delivery services to shippers who do not ship through the Amazon network?

Time will tell, but we believe that Amazon will focus, at least at the outset, on how best to grow their retail business by going after manufacturers and distributors already in their network.

With all of this new information in their hands, would this be an ideal time for parcel shippers to be contacting their FedEx and UPS reps in an effort to negotiate lower rates to stay with them? We certainly think it’s worth a try.

to receive our FREE white papers:

to receive our FREE white papers: