Recently Published on Our Logistics Strategies Substack

For decades, logistics was treated as an operational necessity—important, but rarely recognized as a lever for real portfolio value creation.

That time is over.

In today’s environment—defined by surging tariffs, freight volatility, and shifting sourcing strategies—the cost-to-serve equation is changing fast.

And it’s quietly gutting margins across portfolio companies.

Private equity firms that continue to treat logistics as a “back-office” function are leaving serious value on the table. Those that recognize the shift are gaining a real financial edge.

The New Cost-to-Serve Reality

Several factors have converged to shift logistics from an operational necessity to a financial imperative:

- Tariffs: 104% surcharges on Chinese imports (April 2025) are reshaping landed costs across industries.

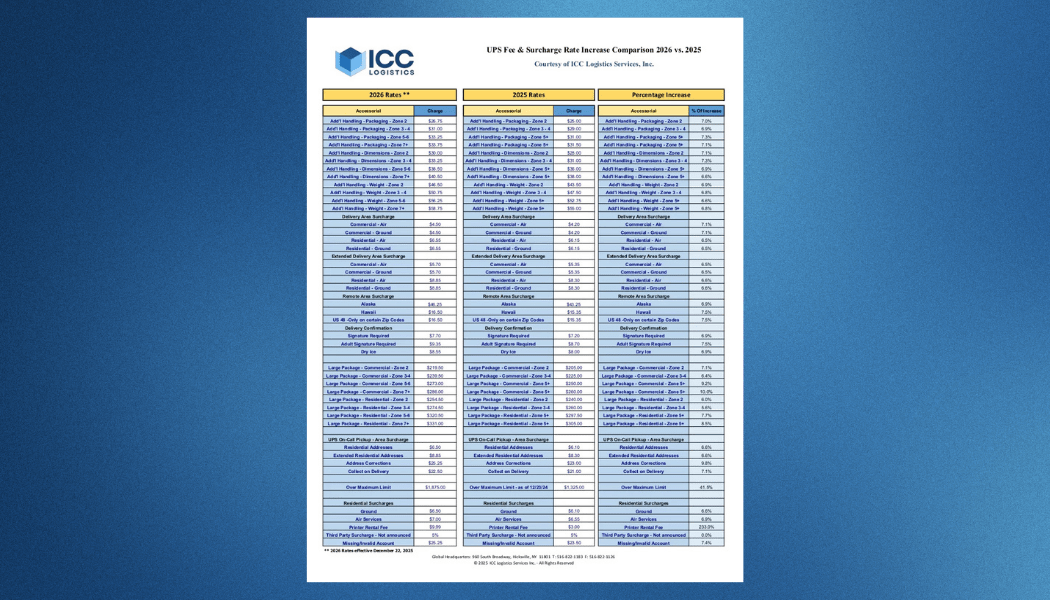

- Freight Volatility: Accessorials and pass-through fees are up 18–32% year-over-year.

- Legacy Contracts: Many shipping and carrier contracts remain outdated and unoptimized.

- Global Sourcing Pressures: Landed cost models built on pre-pandemic assumptions no longer hold.

Across retail, manufacturing, healthcare, and e-commerce portfolios, silent margin erosion is happening daily—often unnoticed until P&Ls feel the strain.

What We’re Seeing at ICC Logistics

Working directly with shippers and operators, several patterns are emerging:

- 🚩 Carrier contracts that haven’t been renegotiated in three or more years

- 🚩 Cost forecasting based on outdated landed cost assumptions

- 🚩 Supply chains optimized purely for cost, with limited resilience or flexibility

- 🚩 Hidden surcharges and pass-through fees compounding quietly

- 🚩 Lack of structured carrier negotiation or diversification strategies

In many cases, shipping, freight, and sourcing frameworks remain anchored in a pre-2020 world—leaving portfolio companies highly vulnerable to sudden tariff shocks, sourcing delays, and freight rate swings.

The impact? Margin loss that could have been avoided—and value leakage that compounds during hold periods.

There’s Real Opportunity in the Chaos

The U.S. logistics consulting industry itself reflects this growing shift:

- Market Size (2025): $28.5 billion

- 5-Year CAGR (2019–2024): +4.2%

- Active Firms: 51,469 (+2.4% YoY)

Industries leading the adoption of logistics strategy as a value creation tool include:

- Retail & E-Commerce

- Manufacturing

- Automotive

- Food & Beverage

- Healthcare

Private equity is catching on—but not fast enough.

The firms that move first—integrating logistics strategy into diligence, post-close planning, and hold-period execution—will lead.

The rest will be left reacting to margin erosion they could have prevented.

Logistics consulting isn’t optional anymore. It’s a competitive advantage.

Where Logistics Fits in the Deal Cycle

Key Integration Points:

Due Diligence: Benchmark cost-to-serve, uncover contract risks early

Post-Close: Quick wins that improve baseline profitability and fund other operational initiatives

Hold Period: Sustainable margin expansion without disruptive restructurings

Exit Prep: Improved operations strengthen valuation multiples and exit narratives

Why Now?

- Freight markets and tariff policies are not stabilizing.

- Margins are under more pressure than ever.

- Supply chain complexity is only increasing.

Ignoring logistics no longer just risks operational inefficiency—it risks financial underperformance.

In today’s environment, logistics is not operational.

It’s financial.

Stay Ahead of the Curve

This article was originally published on our Logistics Strategies Substack. For timely insights on logistics, supply chain strategy, and cost-to-serve optimization, subscribe here to Logistics Strategies and get updates delivered directly to your inbox.

to receive our FREE white papers:

to receive our FREE white papers: