It’s the time of year that most shippers are trying to finalize their 2025 budgets. This has become increasingly more difficult given the creative pricing tactics being utilized by the major Parcel carriers to boost profits. Both FedEx and UPS have announced 5.9% Average General Rate Increases for 2025 within the last few weeks. FedEx released their 2025 rate charts earlier this month. UPS just released their rate charts within the last few days.

2025 Parcel Rate & Fee Analysis: How UPS & FedEx Increases Will Impact Shippers

Now that actual rates have been provided, it is time for shippers to decide how to incorporate these increases into their shipping budgets and shipping policies. Companies that provide free shipping will need to consider increasing the sale price of their goods, or free shipping minimums to help protect profit margins. Companies that charge for shipping will need to consider increasing their shipping fees.

But first, it’s crucial to fully understand the actual impact of the new rates. As time has gone on, the average increase percentages that both carriers have announced has become less and less important. It has been widely documented and proven that the actual increase that a shipper should plan for needs to be based on their actual shipping characteristics. The bottom line is that the 5.9% increase is just an average. The actual increase varies by the service used, weight and zone of the package.

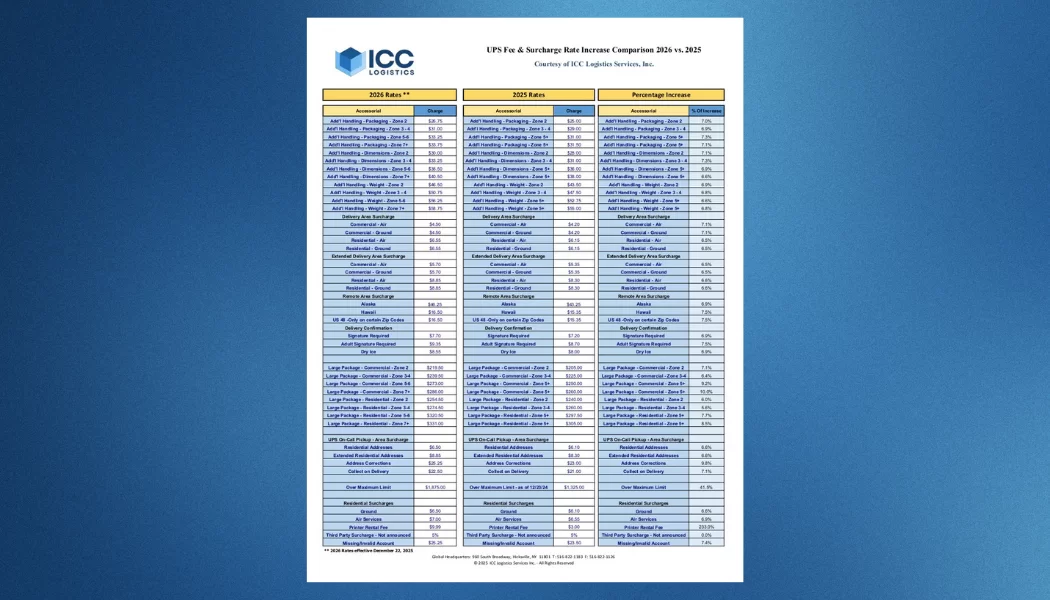

To help provide shippers with some insight, we have put together some comparisons to help demonstrate the cell by cell impact of the new UPS rates. We had provided the same analysis of FedEx rates after they released new rates earlier this month.

You can download all the charts and data in one place by clicking the link at the bottom of this article.

The FedEx analysis that we had prepared for their Ground service showed a cell by cell increase that actually varied between 4.4% to 7.2% depending on weight and zone of the package(s). We saw the same scenario for FedEx Air products, with increases varying from as low as 3% to over 7.5%.

The UPS increases for Ground service appear to be somewhat evenly spread across their rate chart. However, it appears that heavier weight packages will experience a little more of an increase compared to lighter weight packages.

The increase for UPS Air services also appears to be somewhat evenly spread across their rate charts. However, it appears that increases for 2nd Day Air rates are higher than increases on Next Day Air, and Next Day Air Saver.

Additionally, Accessorial rate changes can have a major impact on a shippers increase in cost. Our FedEx GRI analysis had shown that they increased the fees for Additional Handling and Oversize packages by more than 25% across the board. Our analysis also showed that all of the Accessorial rate increases for FedEx were more than 5.9%.

Our analysis of new UPS Accessorial rates shows similar results. Companies that ship packages that qualify for the Additional Handling surcharge will see that fee increase by as much as 28.2%. Similar to FedEx, (just about all of the Accessorial increases that UPS has announced are greater than the 5.9% GRI.)

With the increases that UPS and FedEx have just announced, their rates continue to be closely aligned with rates for most UPS Services being slightly more expensive (typically around 1%). The only exception to this is with FedEx Express Saver/ UPS 3 Day Select. UPS rates continue to be significantly lower for this service, (most likely driven by the lower handling costs they incur due to their integrated network.)

For the most part, Accessorial rates appear to be aligned for both carriers. The only notable exceptions to this are in the Additional Handling and Large Package Surcharge categories.

Also, given the never-ending rate increases we have seen from the major carriers, (both announced and unannounced), we thought it would be interesting to compare UPS rates from 2020 to their new 2025 rates. As we suspected- the increases over these 5 years have been significant! Most UPS rates have increased by around 35% or more.

As we had predicted in our previous blogs, UPS has continued to be creative in their pricing approach. They just made changes to Zone charts for the third time this year, (the latest taking place on October 21st. ) This is in additional to multiple Fuel Surcharge increases UPS implemented in the last year. We are in the process of taking a deeper dive into the impact of these Zonal changes, and will release the results within the next couple of weeks.

Given the complexities of Parcel Carrier pricing, along with the increases that occur outside of annual GRI’s, it is extremely difficult for companies to develop accurate budgets. So, there are two key initiatives that shippers must launch now to ensure their ability to protect and grow their profits.

- General Rate Increase Impact Analysis– New carrier rates and surcharges need to be applied to actual Parcel carrier invoice data. This is the only way to truly determine the impact of 2025 Rate changes.

- Rate Increase Mitigation Strategy– Shippers must determine if they are in a position to engage in a renegotiation of their Parcel Agreements, and consider the potential to onboard new parcel carriers to help limit the impact of 2025 rate increases.

Given the fact that many shippers are heading into the holiday Peak Season, it will be challenging to effectively launch these initiatives, which could play a crucial role in the success of many companies in 2025.

The good news is that ICC Logistics is committed to helping shippers drive a successful 2025, and can play a major role in launching these initiatives. So, please reach out to us today to determine if your company is eligible for a free 2025 Parcel Rate Increase Impact Analysis. Let us do what we do best, while you concentrate on your Peak season!

Download Charts Here and Select ‘Comprehensive Parcel Rate & Fee Analysis: 2025 Insights'”

Note: This specific download provides detailed insights on 2025 rates and fees.

to receive our FREE white papers:

to receive our FREE white papers: